Since credit card interest rates are pretty high nowadays, more and more people are looking for alternatives to credit cards, especially in the case of emergencies or when they need money fast. Personal loans can save you in such situations, but only if you have a good credit score; otherwise, rates can get even higher than credit card rates.

What exactly do you use personal loans for? Expectedly, there’s a number of reasons that range from paying for college, repairing your car, and purchasing inventory for your business to going on a vacation, planning a wedding, and moving to another city. Though it all seems quite easy, which it is in most cases, you have to be sure that you understand what you’re getting yourself into. Keep in mind that personal loans can cost you big time. In other words, you have to be very, very careful.

However, if you find a good loan company, you won’t have to worry about a thing. Keep reading about one of those customer-oriented companies in our OneMain Financial review.

OneMain Financial, which is owned by Citibank, offers personal loans to borrowers with the help of their developed branch of networks. You don’t have to be concerned about your credit score since they are willing to help people with scores as low as 600. The best part is that if you apply before noon, you can receive your money during the same business day.

Note that their interest rates are slightly higher than what other online lenders offer, especially if you have an excellent credit score. Additionally, you won’t receive your loan directly from OneMain, meaning they are a company that connects lenders and borrowers. You can, however, be sure that they will find you a deal that will meet all your requirements.

LOAN FEATURES

OneMain Financial specializes in personal loans, which can go as high as $10,000, with the interest rates ranging from 17.99% to 35.99%. These might be slightly higher rates than what you’re used to, but the service is well worth the price.

Most people actually opt for personal loans because there are no restrictions in terms of what you are going to do with the money. Basically, you are free to spend it as you wish and no one will ask you any questions.

You will get the loan in the form of a check, which can then be deposited into your bank account and used for any purpose. All of their loans are unsecured and they require no collateral.

While writing this OneMain Financial review, we found out that this company gives astonishing discounts on insurance policies if you take a loan from them. They hand out unemployment insurance policies, life insurance policies, and disability insurance policies, so if you happen to need any of these, now would be a good moment to contact OneMain Financial.

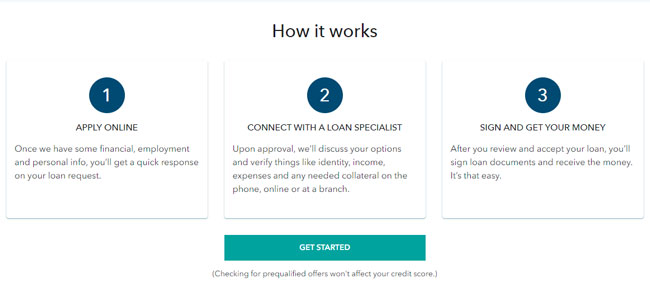

LOAN APPLICATION INFORMATION

Even though OneMain Financial doesn’t focus on your credit score, they still have some pretty strict credit criteria. You have to be employed and you have to have a verifiable source of income. It works best if you are employed full-time with pay stubs. If you happen to be self-employed, they will most likely ask you to deliver your tax returns.

OneMain doesn’t take chances with this. They will help you out if they can but they need to be certain that you will be able to pay off the loan when the time comes. Their criteria are so strict that people who don’t have a steady income will probably get denied for a personal loan.

Some additional conditions include no bankruptcy filings, residency in the US (excluding Alaska, Arkansas, Connecticut, Massachusetts, and a few other states), an established credit, and means to apply online.

REPAYMENT TERMS

Repayment is done automatically. Moreover, there is no need for collateral or home-ownership. Conveniently enough, you get to choose your own due date and you have the choice of either paying over the phone or at one of their branches.

SUMMARY

Finishing off this OneMain Financial review, we can conclude that this company is quite similar to a bank. They have a number of branches around the country, which is great news for people who want to inform themselves properly about loans before applying for one.

The higher interest rates might seem intimidating to some people, but when you take their stability and professional approach into account, it’s definitely a good bargain.